Loihde Plc Half-year report 1 January–30 June 2021

Growth in both businesses, strategic acquisition of Talent Base, Loihde updates its revenue outlook

April–June 2021 in brief

- Loihde Group’s revenue for the second quarter amounted to EUR 26.9 million (EUR 26.0 million), an increase of 4%

- Revenue from the Group’s continuing operations came to EUR 26.9 million (EUR 24.3 million), representing total growth of 11% and organic growth1 of 8%

- Revenue from continuing operations in the security business amounted to EUR 18.3 million (EUR 16.7 million), an increase of 10%

- Revenue from continuing operations in the digital development business amounted to EUR 8.6 million (EUR 7.7 million), representing total growth of 13% and organic growth of 3%

- Adjusted EBITDA was EUR 0.7 million (EUR 1.4 million), or 2.6% (5.2%) of revenue

- Adjusted EBITA was EUR 0.2 million (EUR 0.8 million), or 0.7% (3.2%) of revenue

- In May, Loihde acquired the entire share capital of the IT consulting firm Talent Base Oy, with Talent Base Oy’s CEO Tomi Bergman joining Loihde Plc’s Group Management Team

- The Group began a brand renewal, with the parent company Viria Plc changing its name to Loihde Plc in May and the name Loihde adopted for the Group as a whole

January–June 2021 in brief

- Loihde Group’s revenue was on a par with the comparison period at EUR 52.1 million (EUR 52.2 million)

- Revenue from the Group’s continuing operations came to EUR 51.2 million (EUR 48.9 million), representing total growth of 5% and organic growth of 3%

- Revenue from continuing operations in the security business amounted to EUR 34.7 million (EUR 32.7 million), an increase of 6%

- Revenue from continuing operations in the digital development business amounted to EUR 16.4 million (EUR 16.2 million), representing total growth of 1% and organic growth of -3%

- Adjusted EBITDA was EUR 1.1 million (EUR 2.4 million), or 2.1% (4.6%) of revenue

- Adjusted EBITA was EUR 0.1 million (EUR 1.4 million), or 0.2% (2.7%) of revenue

- In February, Loihde sold the entire share capital of the TV solutions provider Hibox Systems Oy Ab to Accedo AB

1The organic growth of continuing operations excludes the revenue of Hibox Systems Oy Ab, Talent Base Oy and Talent Base AB

Financial targets for the strategy period 2021–2024

Loihde’s Board of Directors has confirmed the financial targets for the strategy period 2021–2024 as follows:

Loihde Group aims to achieve average annual revenue growth of more than 10 per cent, including potential acquisitions. The profitability target is an adjusted EBITDA margin in excess of 10 per cent, calculated in accordance with the IFRS standards. The Group plans to transition to IFRS-compliant reporting during the strategy period. The management estimates that the transition to IFRS reporting will increase the adjusted EBITDA margin by approximately 3–4 percentage points compared to the corresponding figure calculated in accordance with the FAS standards.2

2The difference of 3–4 percentage points, estimated by the management, between the adjusted EBITDA margins calculated in accordance with IFRS vs. FAS standards is mainly due to handling of leases in accordance with IFRS 16.

Outlook for 2021

Loihde Plc has decided to increase its revenue guidance due to the acquisition of Talent Base Oy’s share capital, which was completed on 1 June 2021.

Updated outlook for 2021

Loihde intends to take measures in 2021 related to the achievement of long-term objectives, and the development expenses associated with these measures will temporarily reduce the company’s operational profitability. It can also be expected that the costs that decreased in 2020 due to the COVID-19 pandemic will partly return closer to normal levels in 2021.

In 2021, Loihde expects the revenue of continuing operations in the digital business to grow. Revenue from the security business is expected to remain on a par with the previous year or show moderate growth. The Group’s adjusted EBITDA is estimated to be lower than in 2020.

Previous outlook for 2021 (published on 4 March 2021)

The uncertainty caused by COVID-19 continues in the market and reduces predictability. Viria intends to take measures in 2021 related to the achievement of long-term objectives, and the development expenses associated with these measures will temporarily reduce the company’s operational profitability. It can also be expected that the costs that decreased in 2020 due to the pandemic will return closer to normal levels in 2021.

In 2021, Viria expects the revenue of continuing operations in both the security business and the digital development business to be on a par with the previous year or show moderate growth. The Group’s adjusted EBITDA is estimated to be lower than in 2020.

Key figures

| EUR 1,000 |

4–6 2021 |

4–6

2020 |

Change % | 1–6

2021 |

1–6

2020 |

Change % |

1–12 2020 |

| Revenue, EUR 1,000 | 26,931 | 25,988 | 4% | 52,050 | 52,236 | 0% | 106,823 |

| – Security business | 18,303 | 16,670 | 10% | 34,723 | 32,665 | 6% | 69,122 |

| – Digital development business | 8,613 | 9,354 | -8% | 17,308 | 19,558 | -12% | 37,859 |

| – Other (incl. eliminations) | 15 | -36 | -140% | 18 | 13 | 38% | -158 |

| Revenue, continuing operations1, EUR 1,000 | 26,931 | 24,297 | 11% | 51,166 | 48,919 | 5% | 101,026 |

| – Security business | 18,303 | 16,670 | 10% | 34,723 | 32,665 | 6% | 69,122 |

| – Digital development business1 | 8,613 | 7,654 | 13% | 16,418 | 16,223 | 1% | 32,028 |

| – Other (incl. eliminations)1 | 15 | -28 | -153% | 25 | 31 | -19% | -124 |

| EBITDA | 597 | 1,427 | -58% | 6,655 | 2,199 | 203% | 5,434 |

| Adjusted EBITDA, EUR 1,0002 | 689 | 1,359 | -49% | 1,090 | 2,425 | -55% | 6,160 |

| Adjusted EBITDA, % | 2.6 | 5.2 | – | 2.1 | 4.6 | – | 5.8 |

| EBITA, EUR 1,000 | 110 | 909 | -88% | 5,675 | 1,164 | 387% | 3,386 |

| Adjusted EBITA, EUR 1,0002 | 201 | 841 | -76% | 110 | 1,391 | -92% | 4,113 |

| Operating profit (EBIT), EUR 1,000 | -1,731 | -929 | – | 2,066 | -2,445 | – | -3,838 |

| Adjusted operating profit (EBIT), EUR 1,0002 | -1,639 | -997 | – | -3,498 | -2,218 | – | -3,111 |

| Profit for the period, EUR 1,000 | -1,026 | -269 | – | 2,940 | -2,980 | – | -4,172 |

| Adjusted profit for the period, EUR 1,0002 | -952 | -323 | – | -2,671 | -2,799 | – | -3,590 |

| Equity-to-assets ratio, % | 79.6 | 77.3 | – | 79.6 | 77.3 | – | 81.3 |

| Earnings per share (EPS), EUR 3 | -0.18 | -0.05 | – | 0.51 | -0.54 | – | -0.75 |

| Average number of employees (FTE) | 713 | 717 | -1% | 711 | 711 | 0% | 714 |

1 Revenue from continuing operations does not include Hibox Systems Oy Ab’ revenue for January–February, which amounted to EUR 890 thousand.

2 The adjusted EBITDA, the adjusted EBITA, the adjusted operating profit (EBIT) and the adjusted profit for the period are calculated by excluding capital gains/losses arising from the disposal of properties, fixed asset shares and businesses, insurance and other compensations and other adjustments from the respective reported figure.

3 The own shares owned by the Group are excluded from the total number of shares

CEO Samu Konttinen:

Our revenue from continuing operations grew organically by 8% in April–June. Including inorganic growth, revenue increased by 11%. The total revenue from continuing operations during the period was EUR 26.9 million (EUR 24.3 million). The Group’s adjusted EBITDA was EUR 0.7 million (EUR 1.4 million), or 3% (5%) of revenue. We are in the process of making several investments related to the company’s strategy and business development, which reduce profitability in the short term.

In May, we acquired the IT consulting firm Talent Base Oy, which strengthens our digital development business particularly due to its expertise in data-driven management consulting and solution planning. Together with the existing Group companies BitFactor and Aureolis, Talent Base provides the Loihde Group with a strong digital development network with more than 300 top professionals.

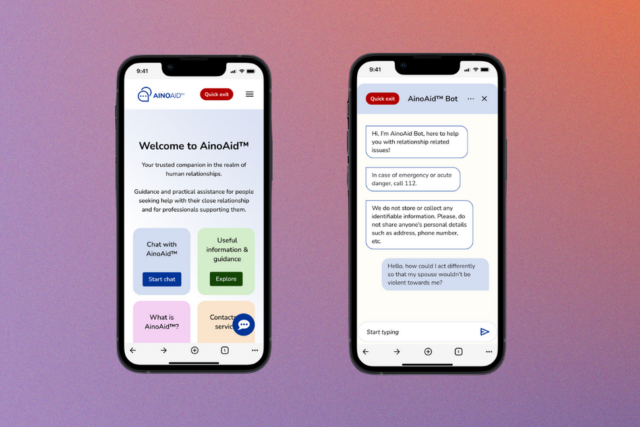

The digital development business picked up slightly during the first half of the year, with revenue from continuing operations in the business growing by 3% organically and by 13% if the Talent Base acquisition is taken into account. Companies and other organisations are actively digitalising their operations. This was reflected in high demand for our services related to, for example, software development, cloud transformation and projects related to analytics and business intelligence. The utilisation rate in the digital development business was at a fairly good level. Accelerating growth will call for increasing the number of personnel. The implementation of our growth plans may be influenced by the prevailing shortage of competent professionals in the market and the success of our recruitment activities.

The 10% growth we achieved in the security business represented exceptional success in both physical security and cyber security. We signed several significant customer agreements with social services and health care organisations and other public sector entities on camera surveillance, access control, locking and personal security solutions. Among our continuing services, the strongest growth was seen in software-driven network solutions and the services produced by the Cyber Security Operations Centre. We have a positive view of the corporate security market, but we expect there to be fluctuation from one quarter to the next.

We are now Loihde. Earlier this year, we started a comprehensive brand renewal that involves adopting the name Loihde throughout the Group. A common brand enables us to better highlight the Group’s strong and diverse expertise, which was previously divided under multiple brands. The transformation into Loihde started with a change of name for the Group and its parent company in the spring. The subsidiaries will switch to new brand names preceded by Loihde at the beginning of September.

In May, we announced that we are exploring opportunities to apply for Loihde Plc’s shares to be listed for trading on Nasdaq First North Growth Market Finland. We have continued our listing-related assessments and the company’s preparations for listing have progressed according to plan.

31 August 2021

Loihde Plc

Board of Directors

Further information

CEO Samu Konttinen, interview requests Director of Communications Tiina Nieminen, tel. +358 44 4113480 or tiina.nieminen@loihde.com